EVERYTHING YOU NEED TO KNOW ABOUT MOVING YOUR HONG KONG BUSINESS TO DUBAI

Are you a business owner in Hong Kong seeking to broaden your horizons and tap into the rapidly growing market of the United Arab Emirates? Company formation in the UAE or another strategic city in the United Arab Emirates can offer a wide range of benefits, including a strategic location, a business-friendly atmosphere, and access to a dynamic market.

The guide below will walk you through the crucial processes and considerations involved in expanding your Hong Kong business to the UAE. With its strategic geographic location, excellent infrastructure, and favorable business regulations, the UAE offers an appealing destination whether you are considering opening a new branch, moving your headquarters, or exploring new avenues for growth.

MAJOR UAE BUSINESS CHANGES: FULL OWNERSHIP & RESIDENCY PERKS

- Since June 2021, the UAE allows 100% foreign ownership for over 1,000 commercial and industrial activities, eliminating the need for a local sponsor in many cases.

- Golden and Green Visas offer 5–10-year residency for investors and business owners, with the flexibility to sponsor family members (including adult children and unmarried daughters), enhancing long-term relocation options.

UAE VS. HONG KONG COST OF LIVING & QUALITY OF LIFE

TRADE LANDSCAPE OUTLOOK BETWEEN HONG KONG & DUBAI

- Bilateral Trade Volume:

- Projected Trade Volume by 2035: AED 175 billion (USD 47.68 billion)

- Year-on-year growth: 6.5% increase from 2024

- Dubai’s Exports to Hong Kong:

- Value: AED 49 billion (USD 13.3 billion)

- Key Export Categories:

- Precious metals and stones: AED 31.85 billion (65%)

- Electrical machinery and equipment: AED 7.35 billion (15%)

- Mineral fuels including oil: AED 4.9 billion (10%)

- Others: AED 4.9 billion (10%)

- Dubai’s Imports from Hong Kong:

- Value: AED 33 billion (USD 9 billion)

- Key Import Categories:

- Electrical machinery and equipment: AED 13.2 billion (40%)

- Precious stones and metals: AED 8.25 billion (25%)

- Watches and clocks: AED 4.95 billion (15%)

- Others: AED 6.6 billion (20%)

EMERGING SECTORS DRIVING DUBAI-HONG KONG TRADE GROWTH

- Knowledge Economy: Increased collaboration in education, research, and innovation

- Financial Services: Growing partnerships in Islamic finance and fintech solutions

- Healthcare and Life Sciences: Rising trade in medical equipment, pharmaceuticals, and biotechnology

- Smart City Solutions: Exchange of expertise and technology in urban development and sustainability

By 2030, these emerging sectors are expected to account for 30% of the total trade volume, reshaping the trade landscape between Dubai and Hong Kong.

WHY MOVE YOUR HONG KONG BUSINESS TO DUBAI & THE UAE?

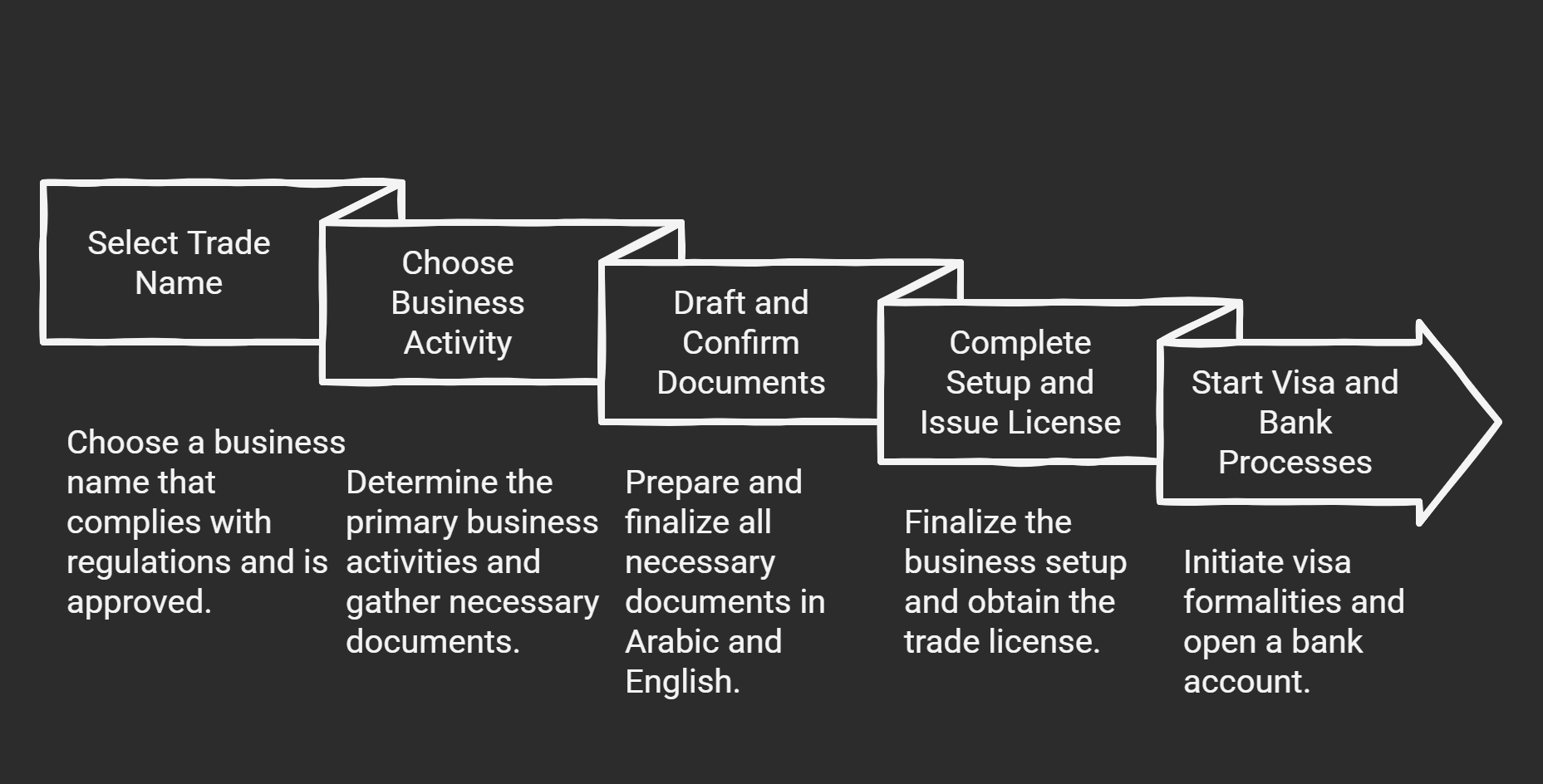

HOW TO MOVE YOUR HONG KONG COMPANY TO DUBAI & THE UAE

Before making your move, consider the following:

- Budget: Assess if relocation is financially viable considering both setup costs and ongoing expenses.

- Business Activities: Ensure your operations can be legally performed in Dubai under current foreign ownership rules.

- Location Needs: Determine whether you require office space, warehousing, or proximity to ports/airports based on your operations.

- Visa Requirements: Evaluate your ability to secure visas for yourself, your family, and your employees.

- Banking Options: Research available banking solutions compatible with your business license.

- Ongoing Support: Understand future compliance obligations to maintain regulatory adherence.

WHICH STRUCTURE SHOULD I SELECT FOR MY HONG KONG COMPANY MIGRATING TO DUBAI & THE UAE?

Choose between the following business structures:

Free Zone Company:

- 100% foreign ownership.

- Attractive tax exemptions.

- Ideal if your operations remain within the free zone.

Mainland Company:

- Broader market access throughout the UAE.

- Now available with 100% foreign ownership for eligible activities.

- Suitable for businesses aiming to engage directly with the local market.

Offshore Company:

- Best for international operations without a physical presence in the UAE.

Branch of a Foreign Company:

- Allows Hong Kong businesses to establish a legal presence in Dubai without forming a separate entity.

These options address different company structures and should be evaluated based on your specific business needs and future growth plans.

WHAT DOCUMENTS ARE REQUIRED TO SET UP MY HONG KONG COMPANY IN DUBAI?

The specific documentation depends on your business type and chosen jurisdiction (Free Zone or Mainland), but generally, you will need:

Identification & Personal Documents

- Passport copies of shareholders, directors, and managers

- Visa copies (if applicable)

- Utility bill for address verification

- Bank reference letter (for certain activities)

Company Formation Documents

- Detailed business plan

- Trade name reservation certificate

- Initial approval certificate

- Memorandum & Articles of Association (MOA/AOA)

Additional Requirements

- Lease agreement for office space (if applicable)

- Copies of your Hong Kong company documents (if applicable)

- Ultimate Beneficial Ownership (UBO) details: passport and utility bill copies for shareholders, directors, and the General Manager

ACCELERATED CORPORATE BANKING WITH INTERNATIONAL PARTNERSHIPS

Creation Business Consultants works with leading international banks, including The Hongkong and Shanghai Banking Corporation (HSBC), Bank of China & other global financial institutions, to support Hong Kong businesses in securing corporate bank accounts in the UAE. Our established banking partnerships help businesses meet compliance standards, reduce approval times & ensure a smooth onboarding process.

With our expertise & banking network, Hong Kong businesses can operate faster, manage transactions efficiently & gain access to UAE’s financial ecosystem with confidence.

Can I Open A Company Bank Account Once I Move My Hong Kong Company To Dubai?

Yes. Once your company is set up and operational, you must open a UAE (or Dubai) corporate bank account. It is mandatory for company shareholders, the General Manager, and any authorized signatories to be present in the UAE to meet the bank representatives and sign the required forms. Banks will require compliance with both local and central banking regulations, and additional documentation may be requested during the onboarding process.

The Documentation Required For A Company Bank Account Includes (But Is Not Limited To):

CAN A FREE ZONE COMPANY DO BUSINESS IN DUBAI? WHICH FREE ZONE IS BEST IN THE UAE?

Free Zone Companies are established in specially designated areas in the UAE with their own tax, customs, and imports regimes. They can operate only within their designated free zone and must partner with a local distributor or establish a branch in the mainland (per UAE Commercial Companies Law) to access the broader UAE market.

With over 50 free zones in the UAE, some cater to specific industries while others support a broad range of business activities. Each free zone has its own regulations, reporting requirements, and lodgement procedures. Choosing the right free zone depends on your business activity, cost considerations, and banking credibility.

TRADE LICENSE COSTS AND RENEWAL IN DUBAI

How Much Does a Trade License Cost in Dubai?

The cost of a trade license in Dubai depends on several factors, including:

- Business activity.

- Required approvals and structure.

- Location and business facilities.

- Number of shareholders and staff.

Government fees and licensing authority charges also vary. Some free zones offer promotional discounts; however, the cheapest option may not always be the best if it compromises your banking credibility.

Trade License Renewal in Dubai

Renewing a trade license in Dubai typically costs 80-90% of the initial company setup fees. Factors that may affect renewal costs include:

- Regulatory and Compliance Requirements – Additional paperwork or approvals may be needed.

- Government Fees and Taxes – These can fluctuate based on business activity.

- Late Penalties – Failing to renew on time can result in fines.

Documents Required for Trade License Renewal

The documentation needed for trade license renewal varies by licensing authority. However, common requirements include:

- Updated company formation documents.

- Proof of ongoing compliance with regulatory standards.

- Additional documents as specified by the licensing authority.

CAN A HONG KONG CITIZEN MOVE TO DUBAI?

Yes. A Hong Kong citizen can move to Dubai if:

- Secure employment and have the sponsoring company process a UAE residency visa, or

- Relocate their business to Dubai to qualify for a UAE residency visa through company formation.

Dubai is a family-friendly city known for its safety, vibrant expat community, and excellent educational options (including British curriculum schools).

CHALLENGES FOR HONG KONG BUSINESSES EXPANDING TO THE UAE

Expanding a Hong Kong-based business to the UAE presents several challenges, including cultural adaptation, language barriers, regulatory compliance, and operational complexities. Understanding and addressing these challenges is crucial for a successful transition.

Cultural Considerations and Business Etiquette

Navigating cultural differences is essential for building strong business relationships in the UAE. Key factors to consider include:

- Respect for Local Traditions – Understanding and adhering to Islamic customs is important.

- Professional and Public Attire – Modest and conservative dress is expected, especially in business settings.

- Religious Observances – During Ramadan, working hours and business operations may be affected.

- Sensitive Topics – Discussions around politics and religion should be avoided.

Language Barriers and Effective Communication

While English is widely spoken in the UAE’s business environment, Arabic remains the official language. To overcome potential language barriers:

- Use Clear, Simple English – Avoid idioms or complex phrases that may cause misunderstandings.

- Engage English-Speaking Professionals – Work with local experts who are fluent in both English and Arabic.

Regulatory and Compliance Challenges

Hong Kong businesses must adapt to UAE-specific corporate governance, compliance, and licensing requirements, including:

- Adhering to UAE Ministry of Economy and Dubai Economic Department policies.

- Navigating approval timelines – Regulatory processes may take longer than anticipated.

- Understanding visa and workforce relocation laws – Securing work permits and relocating staff requires careful planning.

Financial and Banking Considerations

The UAE has distinct banking regulations and financial management requirements, which may differ from Hong Kong’s financial framework. Businesses should:

- Ensure compliance with local banking policies.

- Maintain required account balances.

- Work with financial consultants to streamline transactions and prevent disruptions.

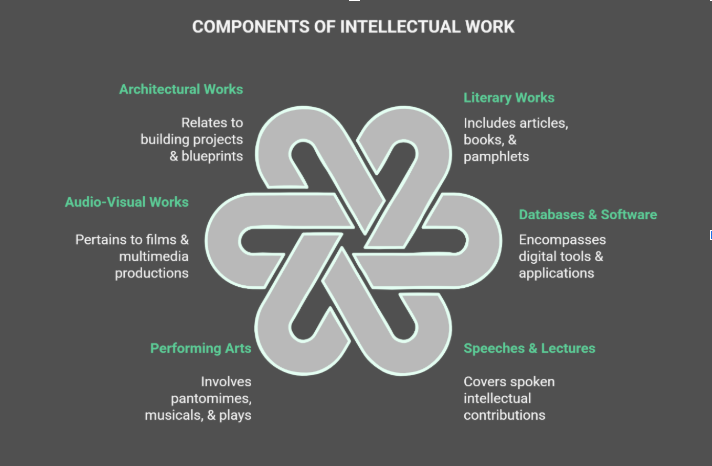

HOW TO PROTECT INTELLECTUAL PROPERTY RIGHTS WHILE DOING BUSINESS IN THE UAE?

- The UAE Ministry of Economy is the designated authority for registering and safeguarding Intellectual Property (IP).

- You can register patents, copyrights, and trademarks via the ministry’s website.

- Federal Law No. 38 of 2021 on Copyrights and Neighbouring Rights provides a comprehensive framework for IP protection.

WHAT IS THE EFFECT OF MOVING A HONG KONG BUSINESS TO DUBAI ON HONG KONG DOMESTIC TAX OBLIGATIONS?

- The UAE-Hong Kong income and capital tax agreement (signed April 12, 2016) covers corporate tax and capital gains, with residency determined by mutual agreement in dual residency cases.

- Businesses should evaluate domestic tax implications and may benefit from double taxation relief.

WHAT IS THE IMPACT OF THE UAE’S CLIMATE ON CERTAIN TYPES OF BUSINESSES?

- Extremely hot temperatures, especially in summer, may impact operations (e.g., manufacturing or outdoor services).

- Heat-sensitive machinery and materials may require additional cooling solutions.

- Businesses providing outdoor services must plan for worker safety by scheduling tasks during cooler periods and ensuring access to shade and hydration.

WHAT ARE THE EFFECTS OF ISLAMIC LAW & CUSTOMS ON BUSINESS PRACTICES?

- Islamic law (Sharia) and local customs significantly influence business operations in the UAE.

- Key considerations include:

- Observing Islamic holidays (e.g., Ramadan).

- Adhering to a modest dress code.

- Avoiding prohibited activities (e.g., handling alcohol without a license, interest-based transactions).

- Understanding and respecting local business etiquette and protocols.

WHAT ARE THE REGULATIONS & PROCEDURES TO BRING EXPATRIATE WORKERS TO THE UAE?

To bring expatriate workers:

- Obtain necessary approvals from the Ministry of Human Resources and Emiratisation (MoHRE).

- Apply for employment visas for your employees.

- Ensure all employees undergo required medical examinations and obtain Emirates ID cards.

- Comply with UAE labor laws and regulations throughout the process.

FREQUENTLY ASKED QUESTIONS

Since June 2021, the UAE allows 100% foreign ownership for over 1,000 commercial and industrial activities without a local sponsor.

Yes, business owners can sponsor family members under Golden or Green Visa schemes.

Business setup can take anywhere from 1 to 6 weeks, depending on the activity, approvals required, and whether you choose a Free Zone or Mainland setup.

For certain Free Zones, business registration can be done remotely.

Corporate Tax: 9% corporate tax applies to annual profits exceeding AED 375,000. VAT: 5% VAT applies to applicable goods and services. No Personal Income Tax: Unlike Hong Kong, Dubai does not impose personal income tax.

Yes, foreigners can establish businesses in Dubai, either in Free Zones (offering 100% foreign ownership) or in the mainland (now allowing up to 100% foreign ownership for many activities). The process involves choosing a business activity, selecting a company name, obtaining initial approval, and preparing the required documents. Dubai is the booming business hub in the Middle East. The UAE and Dubai are home to many cultures with 80% of the population as expatriates.

When you obtain your UAE residency visa, you will be able to apply for a personal and corporate bank account. Holding a UAE residency visa will provide more banking options and banking facilities to support your business bank account. Certain UAE banks will only on-board those that have setup a company and are applying for their UAE residency visa. If you decide to setup a company and not apply for a UAE residency visa, Creation Business Consultants team can provide alternative offshore banking solutions that can be done remotely once your Dubai company setup is completed.

Yes. Creation Business Consultants supports the process by:

- Introducing you to suitable local and international banks

- Analyzing the market and arranging meetings with potential banking partners

- Outlining the initial documentary requirements

- Assisting with the completion of a banking business plan (often mandatory)

- Liaising with the bank to meet KYC, Anti-money Laundering, and compliance standards

- Coordinating document verification meetings

- Managing ongoing communications until your banking credentials are issued

We assist with the establishment of small, medium, or multinational businesses in Dubai and the UAE. It is crucial to consult with a business expert who can guide you on:

- The proper business structure

- Correct business registration for both current needs and future growth

- Visa processing and bank account setup once your business is operational

Health insurance is mandatory in Dubai. Employers must provide adequate coverage, considering various levels of benefits (including dental and vision insurance) to meet employees’ needs.

- Repatriating profits requires a thorough understanding of currency regulations, tax laws, and financial controls.

- Engage specialists in international taxation, accounting, and cross-border transactions to develop compliant strategies that facilitate profit repatriation.

Creation Business Consultants works with the Hong Kong Trade Development Council (HKTDC) Dubai Office to help Hong Kong businesses set up & expand in the UAE. Through this collaboration, businesses gain access to market research, trade missions & investment opportunities while benefiting from our expertise in company formation, corporate structuring, tax registration, visa services & regulatory approvals. By combining HKTDC’s network with our hands-on business consulting services, we provide Hong Kong companies with the right support to establish & grow their presence in the UAE.