ASSET PROTECTION

PLANNING IN

SAUDI ARABIA

Our Asset Protection Planning Service in Saudi Arabia is part of our tax consultancy services in Saudi Arabia.

We provide end-to-end and tailored made solutions to successful families related to acquisition, governance, risk management and preservation of their businesses and wealth through generations. With over 50 years of combined international experience our private clients team offers a winning combination of protection techniques for private individuals and corporate clients including:

- Solutions to ensure confidentiality in high-standing jurisdictions.

- Advice on asset protection plan prior to investment.

- Assets and business protection planning to preserve wealth in the event of bankruptcy, divorce or incapacity.

- Safeguard assets for younger generations.

- Governance structuring through generation and sharia law mitigation.

- Estate and gift tax planning.

- Business succession planning.

- Provision of fiduciary services.

Set-up of asset protection vehicles including trusts, foundations, companies, fund etc.

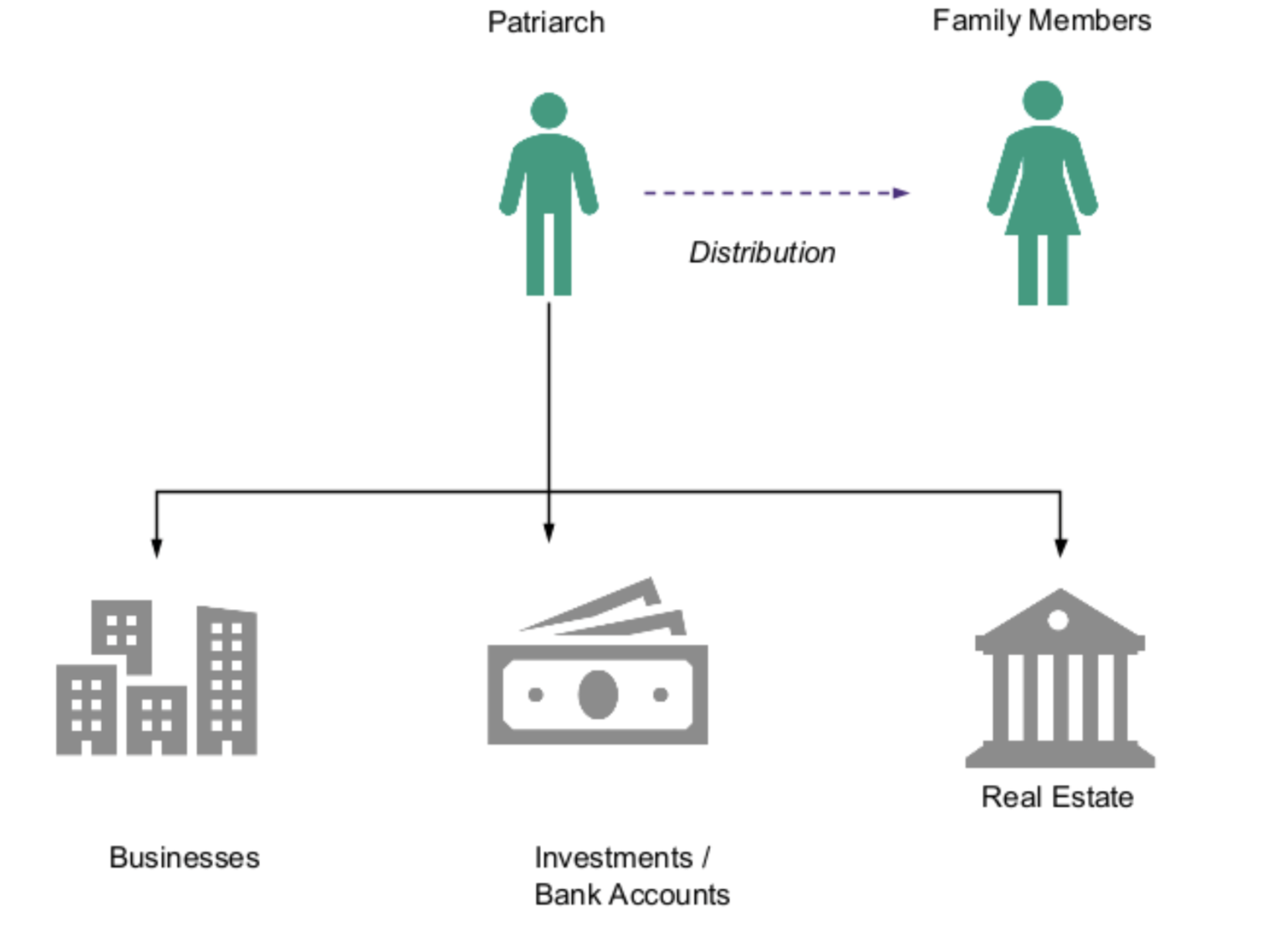

POTENTIAL ISSUES WITH IN-NAME OWNERSHIP

Probate related issues (following death of Patriarch):

- Lengthy and complex procedure involving the UAE Courts.

- Possible unfavorable distribution to direct heirs e.g., spouses, daughters, etc.

- Potential dispute among heirs (children, siblings, wider relatives).

- Dilution of the value of assets that have built up over many years.

- Freezing of bank accounts of Patriarch – Personal and businesses.

No asset protection

- Any asset held in personal names are readily accessible to creditors, governments or other family members who might otherwise have claims against the Patriarch.

No tax planning

- The Patriarch may be subject to tax on his worldwide wealth (include UAE based assets) when/if relocating to another country.

- Any subsequent transfer of UAE assets, once the Patriarch and his descendants relocate to another country, might give rise to inheritance tax and/or wealth transfer tax.

No Privacy

- The name of the Patriarch directly appears as owner on all official documents (e.g., title deed, licenses, etc.) and on the registers of registrars of companies, land registries, etc.

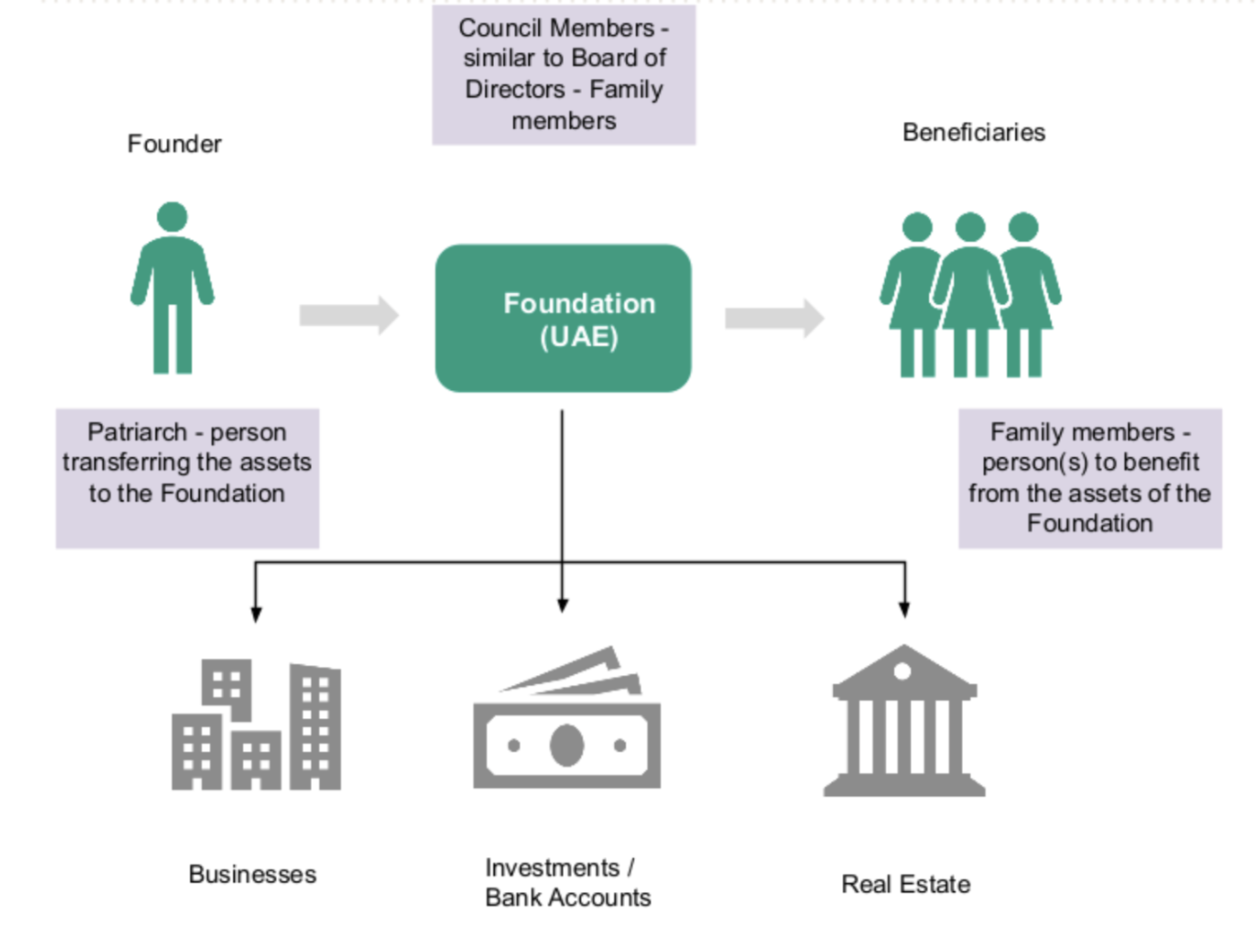

SOLUTIONS OFFERED BY A FOUNDATION

- A Foundation allows the Patriarch to set out his wishes on what is to happen after his/her demise.

- Effective Succession planning – Foundations provide assurance that the assets (or their benefits) will be distributed as per the wishes of the founder under the terms of the foundation.

- Protection of family assets and heirlooms – a foundation’s assets, if properly structured, are not readily accessible to creditors, governments or other family members.

- Establishes a legacy – through a foundation, the founder’s goals continue in perpetuity.

- Privacy – The beneficiaries of a foundation are private and so the founder’s family wealth can be managed more discretely. This provides its own benefits including:

- Reduction of the risk of claims/judicial actions from third parties against the founder and their family to extort a monetary benefit/settlement;

- Better bargaining power when negotiating business deals and/or acquiring assets;

- Reduced risk of being targeted and befriended by unscrupulous individuals in order to access their wealth; and

- Less urgency for potentially uncomfortable discussions around pre-nuptial agreements for the founder or heirs.

- Improves family governance – foundations provide an effective corporate governance framework (similar to a company or single-family office), which allows for wealth to be managed in a professional manner to benefit the founder and their family.

We provide end-to-end and tailored made solutions to successful families related to acquisition, governance, risk management and preservation of their businesses and wealth

through generations. With over 50 years of combined international experience our private clients team offers a winning combination of protection techniques for private individuals and

corporate clients including:

- Solutions to ensure confidentiality in high-standing jurisdictions.

- Advice on asset protection plan prior to investment.

- Assets and business protection planning to preserve wealth in the event of bankruptcy, divorce or incapacity.

- Safeguard assets for younger generations.

- Governance structuring through generation and sharia law mitigation.

- Estate and gift tax planning.

- Business succession planning.

- Provision of fiduciary services.

- Set-up of asset protection vehicles including trusts, foundations, companies, fund etc.

ASSET PROTECTION PLANNING IN SAUDI ARABIA

FAQs

Asset protection planning is a strategic approach that involves identifying and implementing measures to safeguard a family’s wealth from various risks, including lawsuits, creditors, divorce, and bankruptcy. In Saudi Arabia, where economic conditions and legal frameworks can vary, effective asset protection is crucial for families seeking to preserve their wealth across generations. It not only shields assets from potential claims but also ensures that businesses and investments remain intact and are effectively passed down to heirs, maintaining family legacy and financial stability.

Creation Business Consultants offers comprehensive asset protection planning services tailored to the specific needs of families in Saudi Arabia. Our experienced team conducts an in-depth analysis of each family’s financial situation, identifying vulnerabilities and potential risks. We then collaborate with clients to develop customized strategies that encompass various aspects of asset protection, including governance, risk management, and wealth preservation techniques. Our goal is to provide peace of mind to families by ensuring their assets are well-protected and managed efficiently.

Asset protection planning can effectively mitigate numerous risks that threaten a family’s wealth. Common risks include legal claims arising from business operations or personal affairs, bankruptcy due to economic downturns, divorce proceedings that may divide assets, and incapacity that can lead to mismanagement of financial affairs. By proactively addressing these risks through comprehensive planning, families can create a solid defense against potential threats, ensuring that their wealth is preserved and secure for future generations.

At Creation Business Consultants, we employ a variety of asset protection techniques tailored to meet our clients’ needs. These techniques include establishing trusts and foundations that provide legal protection for assets, creating holding companies to separate personal and business liabilities, and implementing governance structures that define management roles and responsibilities. Our approach also involves identifying high-standing jurisdictions for asset confidentiality, ensuring that clients can maintain privacy while securing their wealth from potential claims.

To ensure confidentiality in your asset protection plan, we guide clients in selecting jurisdictions known for their strict privacy laws and regulations. These high-standing jurisdictions offer legal frameworks that protect sensitive information regarding asset ownership and financial affairs. By establishing asset protection vehicles, such as trusts or foundations, in these jurisdictions, families can effectively shield their wealth from public scrutiny and potential legal claims while maintaining the confidentiality of their financial matters.

Governance structuring is a critical component of asset protection that involves establishing clear guidelines for managing a family’s wealth and business interests. This includes defining the roles and responsibilities of family members, creating policies for decision-making, and ensuring compliance with legal requirements. By implementing effective governance structures, families can minimize the risk of disputes, mismanagement, and unauthorized access to assets. This proactive approach helps preserve wealth over generations while aligning with the family’s values and objectives.

Asset protection planning is designed to benefit future generations by establishing mechanisms that safeguard wealth and ensure its responsible management. By creating trusts or foundations, families can provide financial support and education for younger members, ensuring they are equipped to handle inherited wealth. Additionally, asset protection strategies can prevent premature loss of wealth due to external threats, ensuring that future generations have the resources they need to thrive and continue the family legacy.

Estate and gift tax planning is a vital aspect of asset protection as it helps families minimize potential tax liabilities associated with transferring wealth to heirs. In Saudi Arabia, effective estate planning can ensure that assets are passed on without incurring excessive taxation, which could diminish the value of the estate. By utilizing strategies such as gifting assets during the donor’s lifetime or establishing trusts, families can preserve wealth while complying with tax regulations, ensuring that their financial legacy is secure for future generations.

Business succession planning is an integral part of asset protection that focuses on the smooth transition of business ownership and management to the next generation or designated successors. A well-structured succession plan ensures that a business remains operational during transitions, reducing the risk of disputes and mismanagement. By defining clear pathways for ownership transfer and outlining the roles of successors, families can protect their business interests and ensure continuity, which is essential for maintaining the family’s financial stability and legacy.

As part of our asset protection planning services, we offer fiduciary services that include acting as trustees or guardians for family trusts and managing the oversight of assets. Our fiduciaries ensure that all assets are handled in accordance with the established terms of the trust and that beneficiaries’ interests are protected. We also assist in navigating complex legal obligations, ensuring compliance with local regulations, and providing transparency in the management of family wealth. This expertise helps clients focus on their financial goals while entrusting their asset management to qualified professionals.

Creation Business Consultants can assist clients in establishing various asset protection vehicles, each tailored to specific needs and goals. Common vehicles include trusts, which provide legal protection for assets and control over distribution; foundations, which can hold and manage assets for charitable purposes or family benefits; limited liability companies, which separate personal and business liabilities; and investment funds, which can be used to pool resources while enjoying certain legal protections. Each vehicle serves a strategic purpose, allowing clients to optimize their asset protection strategies.

In Saudi Arabia, Sharia law significantly influences asset protection planning. It imposes specific guidelines regarding inheritance, asset distribution, and business practices. At Creation Business Consultants, we ensure that all asset protection strategies are compliant with Sharia principles while still providing effective protection for our clients’ wealth. Our expertise in navigating the complexities of Sharia law allows us to develop solutions that align with our clients’ values, ensuring their financial and spiritual interests are considered in all planning activities.

We begin by conducting a comprehensive assessment of each family’s unique financial situation, objectives, and potential risks. This involves detailed consultations to understand their wealth structure, existing investments, and family dynamics. By identifying areas of vulnerability and aligning our strategies with the family’s goals, we create a customized asset protection plan that addresses their specific needs while also considering future growth and risk management.

Families should review their asset protection plans regularly, ideally on an annual basis or following significant life events, such as marriage, divorce, the birth of a child, or changes in financial circumstances. These reviews ensure that the plan remains relevant and effective in addressing new risks or changes in the family’s situation. By keeping the plan up-to-date, families can respond proactively to any emerging challenges and ensure ongoing protection of their assets.

Trusts offer numerous advantages for asset protection, including enhanced privacy, protection from creditors, and control over asset distribution. They allow individuals to define specific terms for asset management and distribution, ensuring that wealth is preserved according to their wishes. Additionally, trusts can shield assets from legal claims and minimize exposure to taxes, making them an effective tool for families seeking to secure their financial future.

Our team at Creation Business Consultants is well-versed in the complexities of cross-border asset protection planning. We understand the diverse legal landscapes and tax implications involved in managing assets across different jurisdictions. By collaborating with international legal and tax experts, we guide clients through the intricacies of establishing protective measures that are compliant with local laws while optimizing asset security on a global scale.

The process for setting up an asset protection plan begins with an initial consultation to assess the client’s needs and objectives. After a thorough analysis of their financial situation and risk exposure, we develop a tailored strategy that outlines the specific protective measures to be implemented. This includes establishing any necessary asset protection vehicles and governance structures. Once the plan is finalized, we assist with the implementation and ongoing management, ensuring compliance and effectiveness over time.

To begin the process of asset protection planning with Creation Business Consultants, simply reach out to our team for an initial consultation. During this meeting, we will discuss your specific needs, assess your current financial situation, and outline the steps required to create a comprehensive asset protection strategy tailored to your goals. Our dedicated professionals will guide you through the entire process, ensuring a smooth and efficient experience.

Asset protection planning enhances your overall financial strategy by safeguarding your wealth from potential risks, optimizing tax liabilities, and ensuring that your assets are preserved for future generations. This proactive approach allows families to focus on growth and legacy, knowing that their financial interests are secure. By implementing comprehensive asset protection strategies, families can create a robust financial foundation that supports their goals and aspirations while minimizing exposure to unforeseen challenges.

Creation Business Consultants distinguishes itself in asset protection planning through our extensive international experience combined with a deep understanding of the local legal landscape in Saudi Arabia. Our tailored solutions are designed to meet the unique needs of families, leveraging best practices from around the world while considering local regulations and cultural values. Our commitment to personalized service and expertise allows us to effectively protect our clients’ assets while preserving their family legacy.