INTERNATIONAL

TAX SERVICES

IN SAUDI ARABIA

Our International Tax services in Saudi Arabia are part of our tax consultancy services in Saudi Arabia.

More than ever, multinational enterprises need to look at their current group structures and look for cross-border opportunities for business expansion purposes.

In today’s dynamic tax environment, it is important that multinational groups have robust tax structures and consider both short-term and long-term tax planning opportunities. It is important to understand the tax requirements of each jurisdiction in which they operate and assess the impact of domestic tax laws, double tax treaties and multilateral agreements on cross-border transactions.

Multinational groups must be forward-thinking and anticipate the potential short-term and long-term consequences of tax planning decisions at a global level and in the context of their wider business objectives.

We support multinational groups to optimise their tax structures. We can also assist businesses in analysing existing group transactions and inter-group supplies, as well as advising on potential implications of various taxes to facilitate an efficient group tax structure.

COMPANY EXECUTIVES SHOULD BE ASKING:

- Where should they locate their headquarters?

- Does the company have sufficient economic substance especially if it located in a low or no tax jurisdiction?

- What are the tax costs and benefits of entering into a new market?

- Which entity should be used for investing into a new jurisdiction?

- What are the regulatory requirements?

- How should operations be financed?

- What is the impact to the effective global tax rate?

Additionally, frequent changes to tax legislation and greater scrutiny of tax structures also require executives to:

- Ensure that their tax planning remains appropriate given changes in business operations.

- Keep track of frequent changes in tax laws in multiple jurisdictions.

- Manage compliance and internal control requirements.

MANAGING GLOBAL AND LOCAL TAX RISKS SIMULTANEOUSLY AND IDENTIFYING OPPORTUNITIES

Our international tax team can help you avoid the pitfalls and seize tax opportunities by helping you manage the complexities of multiple tax systems and international regulations around the world.

We address your concerns with an international mindset. We have helped several clients plan expansion and implementation of tax structures across the Middle East, Africa, Asia and Europe.

Our assistance covers tax efficient structuring of inbound and outbound investments using, where necessary, our long-standing relationships with global correspondent firms, including:

- International tax planning for business change, expansion into new jurisdictions and cross border transactions.

- International group restructuring.

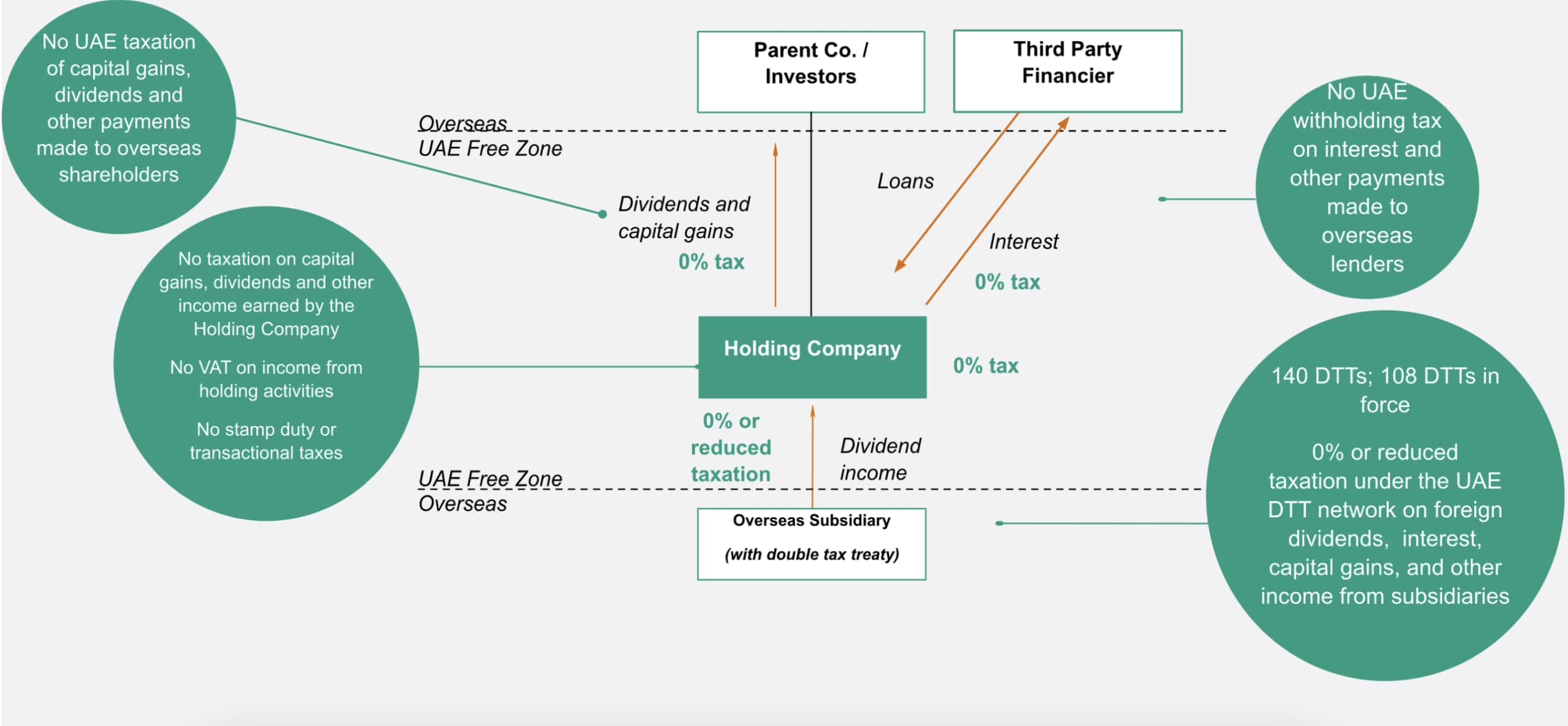

- Tax efficient structuring of inbound and outbound investments.

- Most suitable vehicle(s) for the considered investments.

- Global capital structure planning, including efficient cross-border finance, repatriation and cash access planning.

- Transfer tax/stamp duties implications.

- Corporate tax implications.

- Withholding tax implications.

- Capital gains tax implications upon exit.

- Value Added Tax, customs and excise.

- Economic Substance Requirements (ESR).

- Country by Country reporting.

- Real estate transfer tax/transfer tax/stamp duty implications.

- Applicability of double tax treaties.

- Entitlement to obtain a tax residency certificate.

- Foreign investment restrictions.

- Coordination of international tax reporting and global compliance management.

- Group tax health checks.

INTERNATIONAL TAX IN SAUDI ARABIA FAQs

International Tax Services offer several advantages, including the optimization of tax liabilities, ensuring compliance with local and international regulations, and strategically planning for cross-border transactions. By leveraging these services, businesses can enhance their operational efficiency, minimize risks associated with tax audits, and potentially reduce their overall tax burden. If you’re interested in optimizing your tax strategy, contact us today to discuss how our expertise can benefit your organization.

To evaluate tax implications, businesses should conduct comprehensive research on the local tax landscape, including corporate tax rates, available incentives, and compliance requirements. This process may involve analyzing existing tax treaties, understanding local regulations, and assessing any economic substance requirements. Engaging with international tax experts can provide deeper insights and help tailor a strategic tax plan that aligns with market entry goals. Reach out to our team to start assessing your market expansion strategy and uncover potential tax advantages.

Economic Substance Requirements mandate that entities demonstrate sufficient economic activity in a jurisdiction to benefit from tax incentives. These requirements are crucial for multinational companies as they mitigate the risk of tax avoidance allegations. Compliance with ESR ensures that companies maintain a legitimate business presence in low or no tax jurisdictions, safeguarding against potential penalties. Contact us to learn how to navigate ESR effectively and ensure your international operations remain compliant.

Transfer pricing involves setting prices for transactions between related entities across borders and is a critical aspect of international tax compliance. Properly structured transfer pricing strategies ensure compliance with local tax laws, which can help reduce the risk of audits and disputes with tax authorities. Additionally, accurate transfer pricing documentation can substantiate intercompany transactions, supporting the organization’s overall tax strategy. Let us assist you in developing a robust transfer pricing strategy to safeguard your business against regulatory scrutiny.

Obtaining a tax residency certificate involves submitting an application to the relevant tax authority in Saudi Arabia, along with necessary documentation such as proof of business operations, financial statements, and evidence of tax compliance. This certificate is vital for benefiting from double tax treaties, which can reduce withholding tax rates on cross-border transactions. If you need help navigating this process, contact us today, and we’ll guide you through obtaining your tax residency certificate efficiently.

Multinational companies can manage global tax risks by establishing a comprehensive tax governance framework that includes regular audits and health checks, staying informed about changes in international tax laws, and implementing robust compliance measures. Collaborating with experienced tax advisors can provide valuable insights into emerging risks and help formulate strategies to mitigate them. Connect with our experts to develop a tailored risk management strategy for your multinational operations.

Withholding tax is applied to payments made to foreign entities, such as dividends, interest, and royalties. Understanding the applicable withholding tax rates and the potential benefits of double tax treaties is crucial for minimizing tax exposure. Failure to account for withholding taxes can lead to unexpected costs, affecting the profitability of cross-border transactions. Contact us to gain insights into managing withholding taxes effectively and ensuring your cross-border transactions are tax-efficient.

A well-structured global capital plan enables businesses to optimize their financing strategies across different jurisdictions. It includes considerations for repatriating profits, managing currency risks, and adhering to local regulations. A clear capital structure can enhance cash flow and financial flexibility, ultimately supporting growth objectives. If you want to develop a robust global capital structure plan, reach out to our team for expert guidance tailored to your business needs.

Aligning international tax planning with business objectives requires a thorough understanding of the company’s strategic goals, market dynamics, and regulatory environment. Regular consultations with tax advisors help in adjusting tax strategies to support growth while ensuring compliance. This alignment enhances decision-making and operational efficiency. Contact us today to learn how we can assist you in integrating your tax planning with your business strategy for optimal outcomes.

Various industries, including manufacturing, technology, real estate, and finance, can benefit significantly from International Tax Services. Each sector has unique tax considerations and opportunities for optimization. Tailored tax strategies can help enhance profitability and compliance, ensuring that businesses leverage available incentives and navigate complex regulations effectively. If your industry is seeking tailored international tax solutions, reach out to us today for specialized support that meets your specific needs.