This article was updated on July 5th, 2023

- Services

- [email protected]

- Dubai: +971 4 878 6240 Riyadh: +966 56 865 2329

WHY SETTING UP A FAMILY OFFICE CAN MAKE YOU MORE MONEY!

November 25, 2020

BUDGET & FORECAST PLANNING: THIS IS WHAT PROFESSIONALS DO

December 15, 2020

FIND OUT WHY YOU NEED TO TRANSFER YOUR COMPANY TO THE UAE

This article has been researched and written by Scott Cairns and the team at Creation Business Consultants and has not used AI in generating this article.

Transferring your company to the UAE may be the right move to play next. There has never been a better time to explore the UAE as a jurisdiction to transfer your business. Below we explain the process of company transfer and the pull factors the UAE has on offer.

WHAT IS CORPORATE MIGRATION / RE-DOMICILATION?

Corporate migration – or corporate re-domiciliation can also be referred to as the transfer of domicile or transfer of incorporation.

This is a method in which a company moves its “home” or “domicile” by shifting it to the laws of incorporation and registration of companies in another destination jurisdiction.

Once the company has been deleted from the register of companies in the originating jurisdiction, the entity would continue to preserve its legal identity, assets, and obligations as a registered company in the new jurisdiction.

WHY IS COMPANY TRANSFER OR CORPORATE MIGRATION TO THE UAE ATTRACTIVE?

In accordance with the laws of both originating (outbound) and destination (inbound) jurisdictions, the company looking to “redomicile” would not need to undergo the process of liquidation within the originating jurisdiction. Once migration is complete, the company would still be able to maintain its current track record and previous history. The company would simply merge into the new destination jurisdiction and take advantage of all the benefits of the inbound jurisdiction. The UAE is an attractive jurisdiction for company migration. There are multiple uses for corporate migration such as:

- Benefit from a compatible jurisdiction.

- Taking advantage of favourable tax regimes.

- Using the jurisdiction to access new markets.

- Versatile infrastructure platform for growth.

- Migration of Intellectual property.

- Strong compliance and banking measures.

OECD INCLUSIVE FRAMEWORK ON BEPS AND THE COMMITMENT TO IMPLEMENT THE STANDARD ACROSS THE UAE

The UAE joined the Inclusive Framework back in 2018 to be in line with other G20 states, committing to international standards, and the Organization for Economic Co-operation and Development’s (OECD) initiative on Base Erosion and Profit Shifting (BEPS).

Action 5 of the OECD’s Base Erosion and Profit Shifting (BEPS):

‘Countering Harmful Tax Practices More Effectively, Taking into Account Transparency and Substance’, focuses on tackling the process that may eradicate the tax base of other jurisdictions and is one of the four minimum BEPS standards.

The standard aims to prevent business activities from being relocated to jurisdictions with ‘no or only nominal tax’ so to circumvent the substance requirement. The standard requires that the ‘core income generating activities’ (CIGA) for certain highly geographically mobile sectors of business activity must be conducted with qualified employees and operating expenditure in the ‘no or only nominal tax’ jurisdiction.

Another key driver for corporate migration is the requirement for an entity to demonstrate an adequate “economic presence” in its jurisdiction that is relevant to the activities it undertakes. If economic substance cannot be to be met for an entity in a particular jurisdiction, options such as: changing of tax residency or re-domiciliation to another jurisdiction, e.g., the UAE are appealing and available subject to meeting certain criterion.

WHY TRANSFER YOUR COMPANY TO THE UAE?

The UAE has established itself as one of the leading structuring centres within the region and provides a range of corporate vehicles and regimes for onshore and free zone.

Dubai Multi Commodities Centre (DMCC) free zone and Jebel Ali Free Zone (JAFZA) free zone are a catalyst to a solid relocation route for a substantial range of businesses. Both DMCC and JAFZA free zones have a wide list of licensed activities. Inbound destined companies should be operational for a minimum of 2 years, in good standing and should submit audited financial statements to be eligible for redomicile.

A zero-tax regime, along with an extensive network of tax treaties, most of which reduce the Withholding Tax (WHT) and Capital Gains Tax (CGT). Although it must be noted that Value Added Tax (VAT) of 5% and UAE Corporate Tax (CT) of 9% applies under the same rules as the mainland UAE entities.

Dubai International Financial Centre (DIFC) free zone and Abu Dhabi Global Market (ADGM) free zone are both globally recognised as a financial hub and platform for international businesses. DIFC and ADGM have international and common law principles making them attractive avenues for corporate migration considerations.

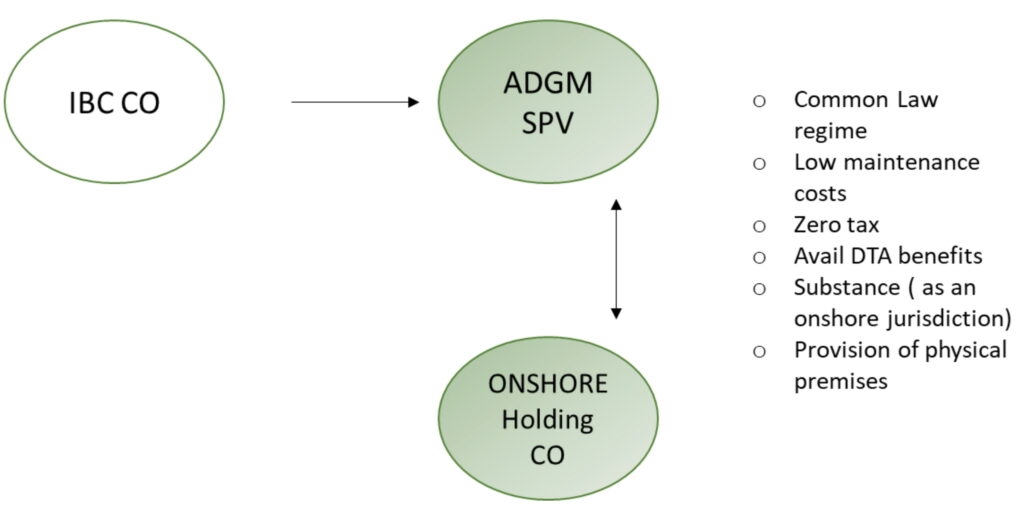

EXAMPLE: Within ADGM you can potentially use a Special Purpose Vehicle (SPV) to morph into an operating company across various activities (regulated or non-regulated). This will appeal to those who may have established a holding company within the jurisdiction to capitalize on market opportunities.

As a business starts growing, the transformed entity could potentially be established as e.g.;

- Ancillary support services

- Proprietary investment

- Holding office

- Family office

- Financial services

CASE STUDY: A UAE offshore company that was used for global trade operations, needed to migrate its evolving business to a more robust jurisdiction. Furthermore, this company wanted to attract foreign investors, raise capital, and enter various contracts with multiple rights. Most importantly the company wanted to have a strong banking solution whilst maintaining onshore UAE operations.

The switch into an Abu Dhabi Global Market entity enabled the company to be transformed under the same legal identity as well as giving the ability to obtain a TRC due to maintaining physical substance within the UAE.

WHY THE APPEAL?

A familiar legal and regulatory framework for international companies destined inbound to the Middle East:

- ADGM provides Common Law (and not mainland UAE Civil / Commercial Law) based on English Law, like the UK companies Act.

- Corporate arbitration and disputes resolution in English within the ADGM court system.

- FSRA providing a robust regulated financial services regime.

For clients who may have established an entity without substance, or who need to further penetrate their operations into a new jurisdiction, are now seeking to pivot to UAE entities to expand and redomicile. Businesses and their investors believe the UAE’s commitment to international standards offers them confidence, and value the level of business and asset protection regimes they can take advantage of within the vast number of vehicles and free zones available within the UAE.

Whilst corporate migration could be implemented to achieve various objectives, a combination of the UAE’s stable and sophisticated legal structure and access to tax treaties make it an appealing alternative for legal corporate re-domiciliation and structuring.

For more information on corporate migration/company transfer or alternative structures contact our expert corporate structuring team for your free 30-minute consultation at [email protected] or call +971 4 878 6240.

Related posts