ASSET PROTECTION

PLANNING IN

DUBAI, ABU DHABI

& THE UAE

Our Asset Protection Planning Service in Dubai, Abu Dhabi and the UAE is part of our tax consultancy services in Dubai, Abu Dhabi and the UAE.

We provide end-to-end and tailored made solutions to successful families related to acquisition, governance, risk management and preservation of their businesses and wealth through generations. With over 50 years of combined international experience our private clients team offers a winning combination of protection techniques for private individuals and corporate clients including:

- Solutions to ensure confidentiality in high-standing jurisdictions.

- Advice on asset protection plan prior to investment.

- Assets and business protection planning to preserve wealth in the event of bankruptcy, divorce or incapacity.

- Safeguard assets for younger generations.

- Governance structuring through generation and sharia law mitigation.

- Estate and gift tax planning.

- Business succession planning.

- Provision of fiduciary services.

Set-up of asset protection vehicles including trusts, foundations, companies, fund etc.

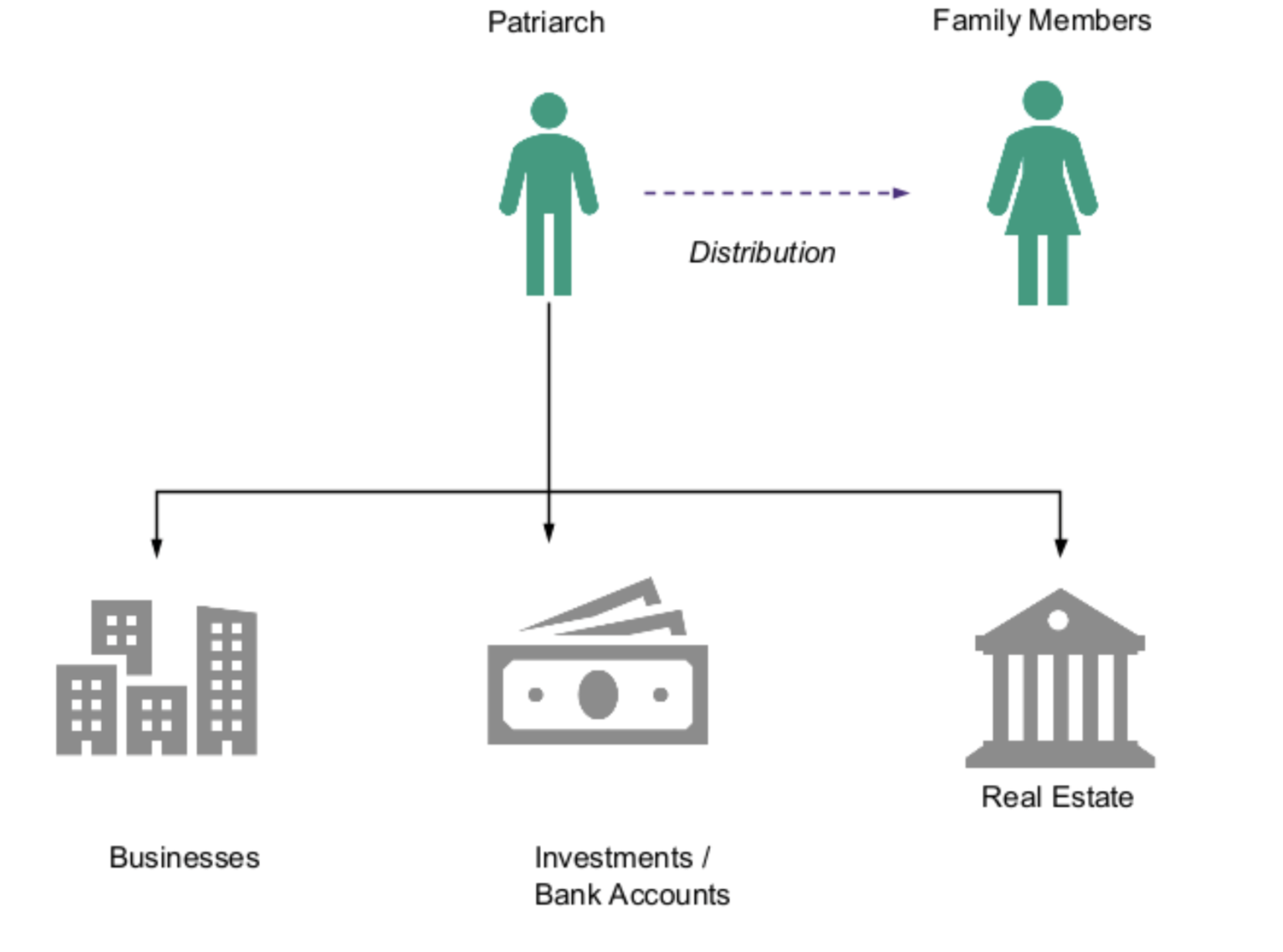

POTENTIAL ISSUES WITH IN-NAME OWNERSHIP

Probate related issues (following death of Patriarch):

- Lengthy and complex procedure involving the UAE Courts.

- Possible unfavorable distribution to direct heirs e.g., spouses, daughters, etc.

- Potential dispute among heirs (children, siblings, wider relatives).

- Dilution of the value of assets that have built up over many years.

- Freezing of bank accounts of Patriarch – Personal and businesses.

No asset protection

- Any asset held in personal names are readily accessible to creditors, governments or other family members who might otherwise have claims against the Patriarch.

No tax planning

- The Patriarch may be subject to tax on his worldwide wealth (include UAE based assets) when/if relocating to another country.

- Any subsequent transfer of UAE assets, once the Patriarch and his descendants relocate to another country, might give rise to inheritance tax and/or wealth transfer tax.

No Privacy

- The name of the Patriarch directly appears as owner on all official documents (e.g., title deed, licenses, etc.) and on the registers of registrars of companies, land registries, etc.

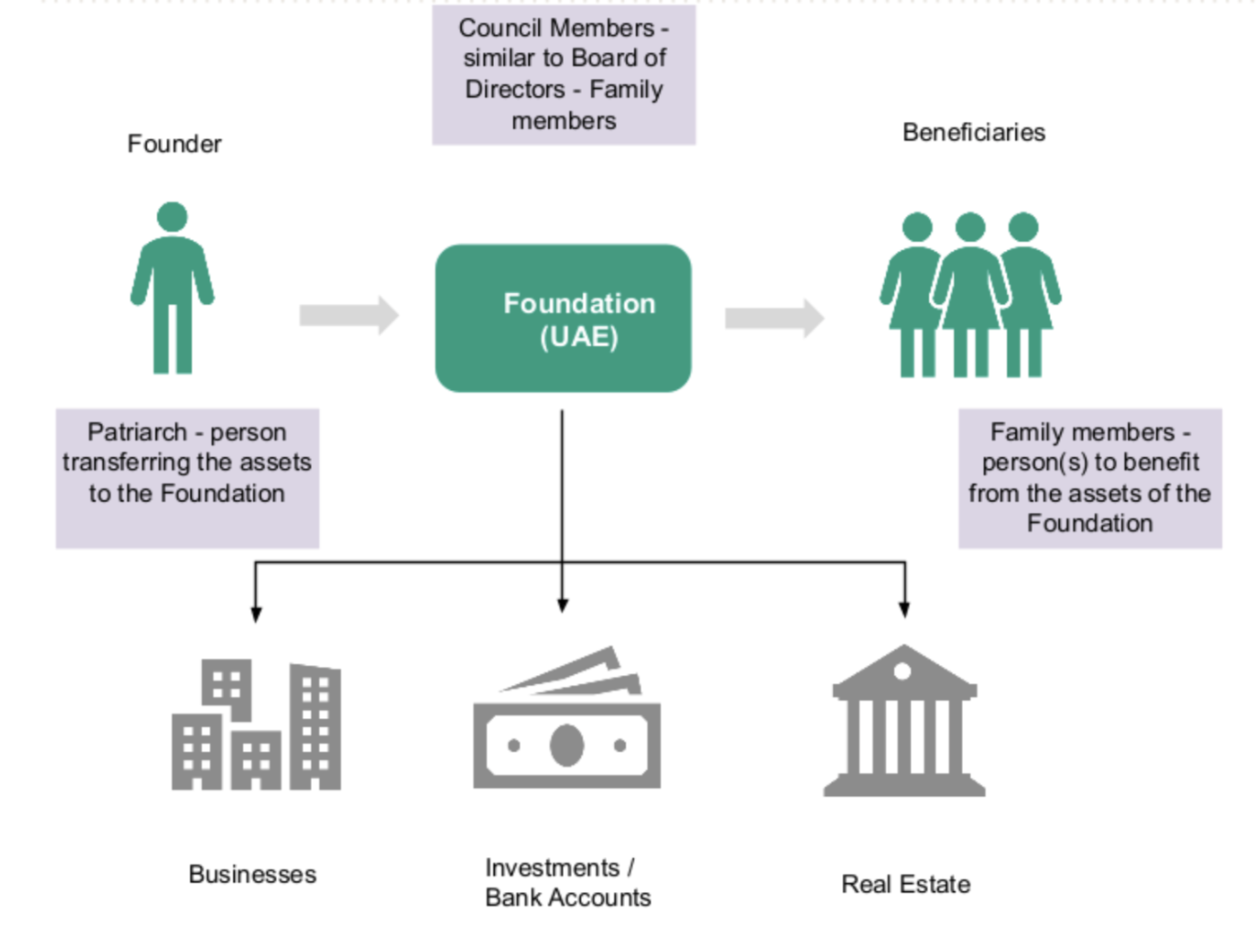

SOLUTIONS OFFERED BY A FOUNDATION

- A Foundation allows the Patriarch to set out his wishes on what is to happen after his/her demise.

- Effective Succession planning – Foundations provide assurance that the assets (or their benefits) will be distributed as per the wishes of the founder under the terms of the foundation.

- Protection of family assets and heirlooms – a foundation’s assets, if properly structured, are not readily accessible to creditors, governments or other family members.

- Establishes a legacy – through a foundation, the founder’s goals continue in perpetuity.

- Privacy – The beneficiaries of a foundation are private and so the founder’s family wealth can be managed more discretely. This provides its own benefits including:

- Reduction of the risk of claims/judicial actions from third parties against the founder and their family to extort a monetary benefit/settlement;

- Better bargaining power when negotiating business deals and/or acquiring assets;

- Reduced risk of being targeted and befriended by unscrupulous individuals in order to access their wealth; and

- Less urgency for potentially uncomfortable discussions around pre-nuptial agreements for the founder or heirs.

- Improves family governance – foundations provide an effective corporate governance framework (similar to a company or single-family office), which allows for wealth to be managed in a professional manner to benefit the founder and their family.

We provide end-to-end and tailored made solutions to successful families related to acquisition, governance, risk management and preservation of their businesses and wealth

through generations. With over 50 years of combined international experience our private clients team offers a winning combination of protection techniques for private individuals and corporate clients including:

- Solutions to ensure confidentiality in high-standing jurisdictions.

- Advice on asset protection plan prior to investment.

- Assets and business protection planning to preserve wealth in the event of bankruptcy, divorce or incapacity.

- Safeguard assets for younger generations.

- Governance structuring through generation and sharia law mitigation.

- Estate and gift tax planning.

- Business succession planning.

- Provision of fiduciary services.

- Set-up of asset protection vehicles including trusts, foundations, companies, fund etc.

WHAT ARE THE RISKS RELATED TO ASSET PROTECTION PLANNING SERVICES IN THE UAE?

Through careful planning and professional advice, the minimal risks connected to Taxes in the UAE can be reduced. You can handle the Tax legislations and procedures easily with the assistance of professional consultants, ensuring adherence to legislations and reducing potential risks.

For an expert consultation, contact Creation Business Consultants via email [email protected] or call +971 4 878 6240 today.

ASSET PROTECTION & ESTATE PLANNING FAQs

Asset protection planning is crucial in business succession to ensure that a business transition occurs smoothly and according to the owner’s wishes. It helps in safeguarding assets from potential creditors, disputes, and taxes, thus facilitating a seamless handover of the business to the next generation. For tailored business succession planning advice, contact [email protected].

Trusts can be an effective tool in asset protection planning by placing assets under the control of a trustee. This can shield assets from creditors and legal claims, as well as provide for the management of assets according to specific terms set by the trust creator. For more information on setting up trusts, email [email protected].

Foundations offer several benefits for asset protection, including confidentiality, control over asset distribution, and protection from creditors and legal claims. They can also support long-term goals such as establishing a legacy and ensuring assets are used according to the founder’s wishes. For assistance in setting up a foundation, contact [email protected].

For individuals, asset protection planning often focuses on personal wealth, estate planning, and protection from personal liabilities. For corporate clients, it involves safeguarding business assets, managing risks associated with corporate operations, and ensuring continuity of business operations. For personalized asset protection strategies, email [email protected].

International regulations can affect asset protection planning by introducing complex compliance requirements and varying levels of protection depending on jurisdiction. It’s important to align asset protection strategies with international laws to ensure effective protection. For advice on navigating international regulations, contact [email protected].

Asset protection planning can help mitigate risks during divorce by ensuring that assets are structured in a way that minimizes potential claims from a spouse. This can involve setting up protective structures like trusts or foundations to preserve wealth. For guidance on asset protection in divorce scenarios, email [email protected].

High-net-worth families should consider strategies such as establishing trusts, foundations, and sophisticated estate planning to protect and manage substantial assets. They should also address privacy concerns and ensure compliance with relevant laws to safeguard their wealth effectively. For advice on protecting high-net-worth assets, contact [email protected].

Yes, asset protection planning can help with tax mitigation by structuring assets in ways that optimize tax benefits and minimize liabilities. This includes strategies for estate and gift tax planning and taking advantage of tax-efficient structures. For help with tax mitigation through asset protection, email [email protected].

Common mistakes include inadequate structuring of protective vehicles, failure to update plans in response to legal changes, and lack of comprehensive estate planning. These errors can undermine the effectiveness of asset protection strategies. For a review of your asset protection plan, contact [email protected].

Fiduciary services enhance asset protection planning by providing professional management and oversight of assets. This includes ensuring that assets are handled according to the client’s wishes and protecting them from potential risks. For more information on fiduciary services, email [email protected].