INTERNATIONAL

TAX SERVICES

IN DUBAI, ABU

DHABI & THE UAE

Our International Tax services in Dubai, Abu Dhabi and the UAE are part of our tax consultancy services in Dubai, Abu Dhabi and the UAE.

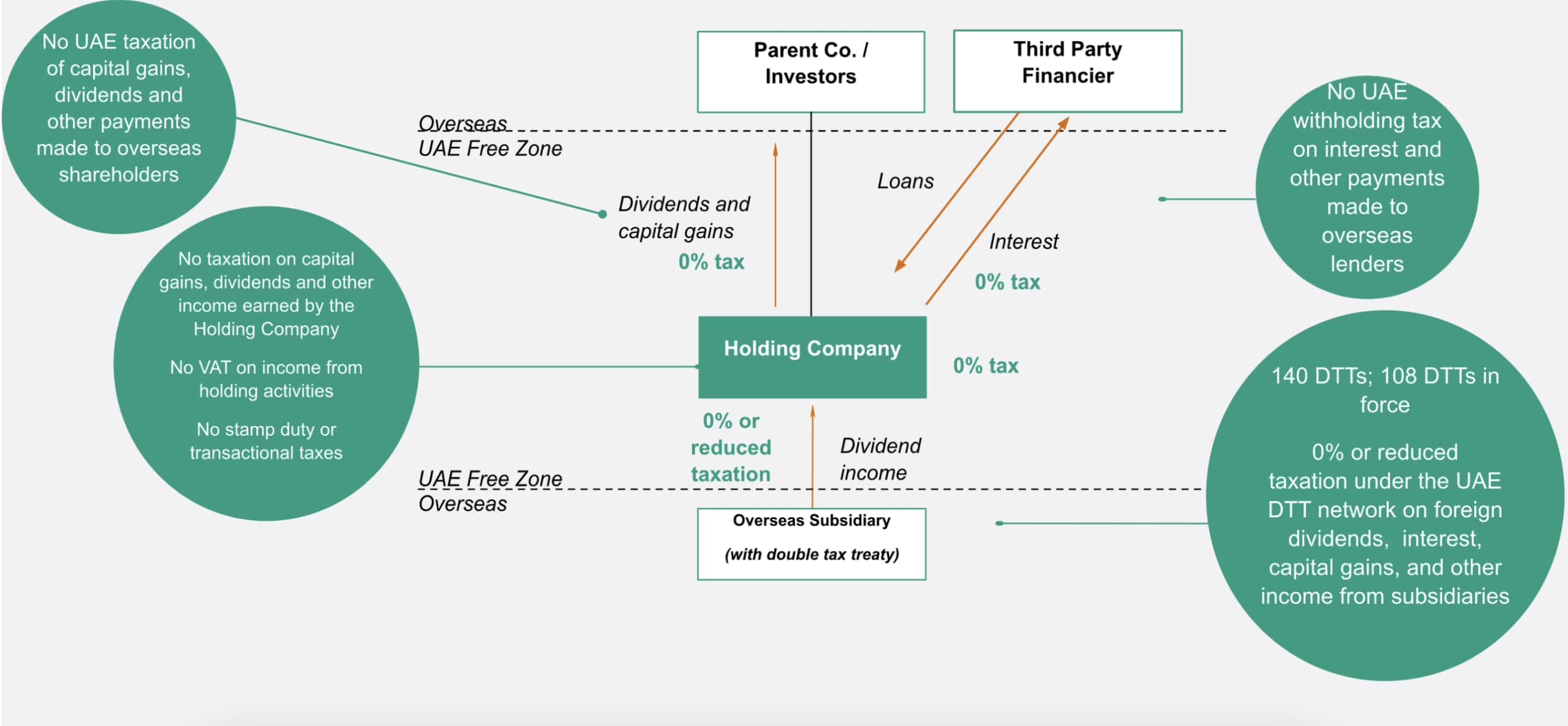

More than ever, multinational enterprises need to look at their current group structures and look for cross-border opportunities for business expansion purposes.

In today’s dynamic tax environment, it is important that multinational groups have robust tax structures and consider both short-term and long-term tax planning opportunities. It is important to understand the tax requirements of each jurisdiction in which they operate and assess the impact of domestic tax laws, double tax treaties and multilateral agreements on cross-border transactions.

Multinational groups must be forward-thinking and anticipate the potential short-term and long-term consequences of tax planning decisions at a global level and in the context of their wider business objectives.

We support multinational groups to optimise their tax structures. We can also assist businesses in analysing existing group transactions and inter-group supplies, as well as advising on potential implications of various taxes to facilitate an efficient group tax structure.

WHAT ARE INTERNATIONAL TAX SERVICES AND HOW DO THEY BENEFIT BUSINESSES OPERATING IN THE UAE?

International tax services include tax planning, compliance, and advisory to manage tax obligations across different jurisdictions. For UAE businesses, these services ensure compliance with local tax regulations, optimize tax strategies, and manage cross-border transactions effectively.

COMPANY EXECUTIVES SHOULD BE ASKING:

- Where should they locate their headquarters?

- Does the company have sufficient economic substance especially if it located in a low or no tax jurisdiction?

- What are the tax costs and benefits of entering into a new market?

- Which entity should be used for investing into a new jurisdiction?

- What are the regulatory requirements?

- How should operations be financed?

- What is the impact to the effective global tax rate?

Additionally, frequent changes to tax legislation and greater scrutiny of tax structures also require executives to:

- Ensure that their tax planning remains appropriate given changes in business operations.

- Keep track of frequent changes in tax laws in multiple jurisdictions.

- Manage compliance and internal control requirements.

MANAGING GLOBAL AND LOCAL TAX RISKS SIMULTANEOUSLY AND IDENTIFYING OPPORTUNITIES

Our international tax team can help you avoid the pitfalls and seize tax opportunities by helping you manage the complexities of multiple tax systems and international regulations around the world.

We address your concerns with an international mindset. We have helped several clients plan expansion and implementation of tax structures across the Middle East, Africa, Asia and Europe.

Our assistance covers tax efficient structuring of inbound and outbound investments using, where necessary, our long-standing relationships with global correspondent firms, including:

- International tax planning for business change, expansion into new jurisdictions and cross border transactions.

- International group restructuring.

- Tax efficient structuring of inbound and outbound investments.

- Most suitable vehicle(s) for the considered investments.

- Global capital structure planning, including efficient cross-border finance, repatriation and cash access planning.

- Transfer tax/stamp duties implications.

- Corporate tax implications.

- Withholding tax implications.

- Capital gains tax implications upon exit.

- Value Added Tax, customs and excise.

- Economic Substance Requirements (ESR).

- Country by Country reporting.

- Real estate transfer tax/transfer tax/stamp duty implications.

- Applicability of double tax treaties.

- Entitlement to obtain a tax residency certificate.

- Foreign investment restrictions.

- Coordination of international tax reporting and global compliance management.

- Group tax health checks.

WHAT ARE THE RISKS RELATED TO INTERNATIONAL TAX SERVICES IN THE UAE?

Through careful planning and professional advice, the minimal risks connected to Taxes in the UAE can be reduced. You can handle the Tax legislations and procedures easily with the assistance of professional consultants, ensuring adherence to legislations and reducing potential risks.

For an expert consultation, contact Creation Business Consultants via email [email protected] or call +971 4 878 6240 today.

UAE INTERNATIONAL TAX FAQs

Managing international tax profiles is essential for any global player, whether experienced or exploring new markets. Frequent changes in tax laws require companies to anticipate both short- and long-term consequences of tax planning decisions. Coordinating tax strategies globally and aligning them with broader business objectives is crucial. For expert tax advice on managing international tax profiles, reach out to us at [email protected].

Executives should consider:

- Where to locate operations

- Tax costs and benefits of entering new markets

- Appropriate entity structures

- Tax regulatory requirements

- Financing operations

- Impact on the effective global tax rate

Understanding these factors helps in making informed decisions about global tax strategy.

International tax planning involves strategies for business change, expansion into new jurisdictions, and cross-border transactions. Proper management helps anticipate tax implications, optimize tax structures, and ensure compliance with global regulations. For a consultation, email us at [email protected].

Foreign companies must comply with UAE tax regulations, including VAT, corporate tax, and financial reporting requirements. Staying updated on these regulations is crucial to avoid penalties and ensure proper tax management. For more details, contact us at [email protected].

International tax laws affect cross-border transactions by determining how transactions are taxed in multiple jurisdictions. This includes transfer pricing, double taxation treaties, and compliance with local regulations. Our team can help you navigate these complexities to optimize your tax position. For assistance, email us at [email protected].

International group restructuring involves reorganizing business operations and entities to optimize tax efficiency and compliance. This can include restructuring subsidiaries, joint ventures, or other entities to align with tax regulations and business goals. For effective restructuring strategies, contact us at [email protected].

Businesses must stay informed about frequent changes in tax legislation and adjust their tax strategies accordingly. This includes monitoring updates in multiple jurisdictions, managing internal controls, and addressing regulatory scrutiny. For assistance, contact us at [email protected].

Coordinating international tax reporting and global compliance management ensures consistency across jurisdictions, reduces the risk of errors, and improves overall tax efficiency. This approach helps in managing global tax obligations effectively and aligns reporting practices with international standards. For expert assistance, email us at [email protected].

Global capital structure planning involves optimizing the financial structure of a business to manage cross-border finance, repatriation, and cash access. Efficient planning helps in minimizing tax costs and improving financial flexibility. For guidance on capital structures, contact us at [email protected].

International tax disputes can be managed through expert advice, negotiation with tax authorities, and representation in tax-related matters. The goal is to achieve favorable outcomes and ensure compliance with international tax regulations. For support, reach out to us at [email protected].

Tax treaties help prevent double taxation and clarify tax obligations between countries. Leveraging these treaties effectively can reduce tax liabilities and improve compliance. For guidance on utilizing tax treaties, contact us at [email protected].

Optimizing your tax strategy involves understanding and adapting to global tax regulations, leveraging tax incentives, and planning transactions to minimize liabilities. Our team provides tailored strategies to help achieve tax efficiency and regulatory compliance. For expert advice, email us at [email protected].

Group tax health checks involve reviewing a company’s tax positions and strategies to ensure they are effective and compliant with current regulations. Regular health checks help identify potential risks and opportunities for tax optimization. For a thorough review, contact us at [email protected].

The Economic Substance Regulation (ESR) requires entities in the UAE to demonstrate substantial economic activity for certain business activities. Compliance is necessary to avoid penalties and ensure alignment with UAE regulations. For details on meeting ESR requirements, email us at [email protected].

Key considerations include choosing the right financing structure, understanding tax implications, and managing cross-border cash flows. Effective financing strategies can optimize tax benefits and support business growth. For advice on financing international operations, reach out to us at [email protected].

Frequent changes in tax laws can impact business operations by altering compliance requirements, affecting tax liabilities, and introducing new reporting obligations. Staying informed and adapting to these changes is essential for managing tax risks and maintaining compliance. For more information, email us at [email protected].

To schedule a consultation, please contact us at [email protected]. Our experts will discuss your international tax needs and provide customized solutions to address your specific requirements.

International tax planning is crucial for business expansion as it helps manage tax implications across different jurisdictions, optimize tax strategies, and ensure compliance with local and international regulations. Proper planning supports successful entry and growth in new markets. For tailored advice, contact us at [email protected].